4th quarter 2021

- Net profit: NOK 703m (450m)

- Return on equity: 12.7 per cent (8.9 per cent)

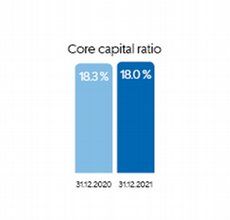

- CET1 ratio: 18.0 per cent (18.3 per cent)

- Growth in lending: 1.8 per cent (1.9 per cent) and in deposits: 1.5 per cent (growth of 2.2 per cent)

- Lending to personal customers rose by 1.6 per cent in the quarter (1.6 per cent), 0.4 per cent lower growth than in the third quarter. Lending to corporate clients rose by 2.1 per cent (2.5 per cent) which was 1.4 percentage points higher than in the third quarter

- Deposits from personal customers rose by 1.4 per cent (0.1 per cent), compared with a decline of 0.5 per cent in the third quarter. Deposits from corporate clients rose by 1.5 per cent (3.8 per cent), compared with a decline of 0.3 per cent in the third quarter

- Net result of ownership interests: NOK 186m (117m)

- Net result of financial instruments (incl. dividends): NOK 33m (80m)

- Losses on loans and guarantees: NOK 32m (242m), 0.07 per cent of total lending (0.54 per cent)

- Earnings per equity certificate (EC): NOK 3.20 (1.99). Book value per EC: NOK 103.48 (94.71)