4th quarter 2020

- Pre-tax profit: NOK 2,378m (3,081m)

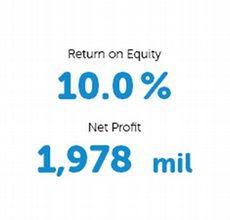

- Post-tax profit: NOK 1, 978m (2,563m)

- Return on equity: 10.0 per cent (13.7 per cent)

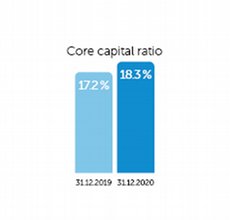

- CET1 ratio: 18.3 per cent (17.2 per cent)

- Growth in lending: 9.0 per cent (4.7 per cent) and in deposits: 13.5 per cent (6.6 per cent) over the last 12 months

- Growth in lending to retail borrowers was 8.2 per cent over the last 12 months (6.4 per cent), and retail loans account for 68 per cent (69 per cent) of total lending

- Growth in lending to corporate borrowers was 10.6 per cent in the last 12 months (1.1 per cent)

- Losses on loans and guarantees: NOK 951m (299m) or 0.54 per cent (0.18 per cent) of total lending

- Earnings per equity certificate (EC): NOK 8.87 (12.14). Book value per EC: NOK 94.71 (90.75)

Results for the fourth quarter of 2020

- Pre-tax profit: NOK 554m (469m)

- Post-tax profit: NOK 450m (346m)

- Return on equity: 8.9 per cent (7.1 per cent)

- Growth in lending: 1.9 per cent (1.4 per cent) and in deposits: 2.2 per cent (2.7 per cent)

- Lending to retail borrowers rose by 1.6 per cent in the quarter (2.0 per cent), 0.6 percentage points lower than in the third quarter. Lending to corporate borrowers rose by 2.5 per cent (0.3 per cent) which was 0.5 percentage point lower than in the third quarter

- Net result of ownership interests: NOK 117m (8m)

- Net result of financial instruments: NOK 53m (8m)

- Losses on loans: NOK 242m (103m), 0.54 per cent (0.25 per cent) of gross lending

- Earnings per EC: NOK 1.99 (1.60)