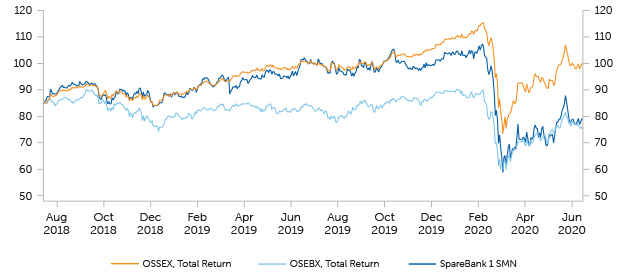

Equity capital certificates

Stock price compared with OSEBX and OSEEX

1 July 2018 to 30 June 2020

|

OSEBX = Oslo Stock Exchange Benchmark Index (rebased) |

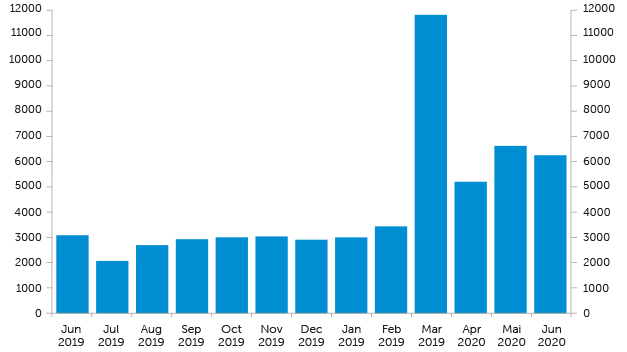

Trading statistics

1 July 2019 to 30 June 2020

| Total number of ECs traded (1000) |

| 20 largest ECC holders | Number | Share |

| VPF Nordea Norge | 5,505,744 | 4.24 % |

| State Street Bank and Trust Comp | 4,171,804 | 3.21 % |

| Sparebankstiftelsen SMN | 3,965,391 | 3.05 % |

| VPF Odin Norge | 3,342,919 | 2.57 % |

| Danske Invest norske aksjer intitusjon II. | 3,190,549 | 2.46 % |

| VPF Pareto aksje Norge | 2,734,480 | 2.11 % |

| VPF Alfred Berg Gambak | 2,397,837 | 1.85 % |

| J.P. Morgan Chase Bank, N.A., London | 2,052,616 | 1.58 % |

| State Street Bank and Trust Comp | 1,992,314 | 1.53 % |

| VPF Eika egenkapitalbevis | 1,941,083 | 1.50 % |

| Pareto Invest AS | 1,810,197 | 1.39 % |

| Forsvarets personellservice | 1,797,946 | 1.38 % |

| Citibank, N.A. | 1,582,586 | 1.22 % |

| VPF Nordea kapital | 1,440,601 | 1.11 % |

| M.P. Pensjon PK | 1,352,771 | 1.04 % |

| Danske Invest norske aksjer institusjon I. | 1,341,275 | 1.03 % |

| VPF Nordea avkastning | 1,249,111 | 0.96 % |

| Morgan Stanley & Co. International | 1,186,816 | 0.91 % |

| VPF Alfred Berg Norge | 1,085,659 | 0.84 % |

| Landkreditt utbytte | 1,075,000 | 0.83 % |

| The 20 largest ECC holders in total | 45,216,699 | 34.83 % |

| Others | 84,619,744 | 65.17 % |

| Total issued ECCs | 129,836,443 | 100.00 % |

Dividend policy

SpareBank 1 SMN aims to manage the Group’s resources in such a way as to provide equity certificate holders with a good, stable and competitive return in the form of dividend and a rising value of the bank’s equity certificate.

The net profit for the year will be distributed between the owner capital (the equity certificate holders) and the ownerless capital in accordance with their respective shares of the bank’s total equity capital.

SpareBank 1 SMN’s intention is that about one half of the owner capital’s share of the net profit for the year should be disbursed in dividends and, similarly, that about one half of the owner capital’s share of the net profit for the year should be disbursed as gifts or transferred to a foundation. This is on the assumption that capital adequacy is at a satisfactory level. When determining dividend payout, account will be taken of the profit trend expected in a normalised market situation, external framework conditions and the need for tier 1 capital.

2nd quarter 2020

- Main figures

- Report of the Board of Directors

- Income statement

- Balance sheet

- Cash flow statement

- Change in equity

- Notes

- Results from quarterly accounts

- Key figures from quarterly accounts

- Statement in compliance with the securities trading act, section 5-6

- Equity capital certificates

- Auditor's report