4th quarter 2022

- Profit before tax and business held for sale: NOK932m (773m)

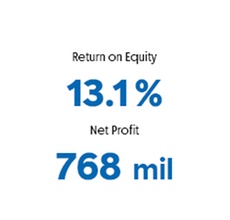

- Net profit: NOK 768m (703m)

- Return on equity: 13.1% (12.7%)

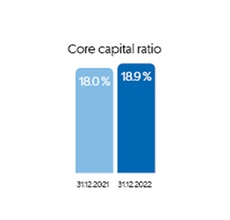

- CET1 ratio: 18.9% (18.0%)

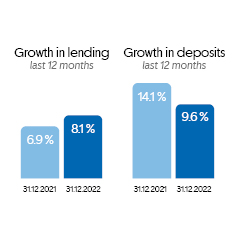

- Growth in lending: 1.1% (1.8%) and in deposits: 1.2% (growth of 1.5%)

- Lending to personal customers rose 1.0% in the quarter (1.6%), 0.2 percentage points lower growth than in the third quarter. Lending to corporate clients rose 1.4% (2.1%) which was 1.0 percentage point lower growth than in the third quarter

- Deposits from personal customers rose 1.4% (1.4%), compared with a decline of 1.9% in the third quarter. Deposits from corporate clients rose 1.1% (1.5%), compared with a decline of 3.1% in the third quarter

- Net result of ownership interests: NOK 195m (186m)

- Net result of financial instruments (incl. dividends): minus NOK 33m (minus 18m)

- Losses on loans and guarantees: NOK 19m (32m), 0.04% of gross loans (0.07%)

- Earnings per equity certificate (EC): NOK 3.53 (3.20). Book value per EC: NOK 109.86 (103.48)