Equity capital certificates

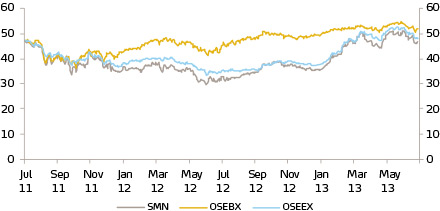

Stock price compared with OSEBX and OSEEX

1 July 2011 to 30 June 2013

OSEBX = Oslo Stock Exchange Benchmark Index (rebased)

OSEEX = Oslo Stock Exchange ECC Index (rebased)

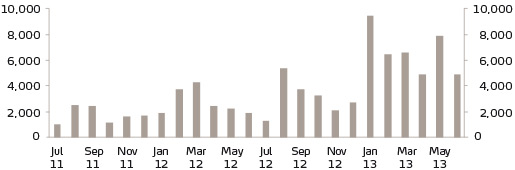

Trading statistics

1 July 2011 to 30 June 2013

| 20 largest ECC holders | Number | Share |

| Reitangruppen AS | 4,519,108 | 3.48 % |

| Odin Norge | 4,168,311 | 3.21 % |

| Sparebankstiftelsen SpareBank 1 SMN | 3,965,391 | 3.05 % |

| Odin Norden | 2,899,083 | 2.23 % |

| Frank Mohn AS | 2,876,968 | 2.22 % |

| Vind LV AS | 2,736,435 | 2.11 % |

| MP Pensjon PK | 2,058,415 | 1.59 % |

| Stenshagen Invest | 1,824,449 | 1.41 % |

| Verdipapirfondet Fondsfinans Spar | 1,800,000 | 1.39 % |

| The Resource Group TRG | 1,768,000 | 1.36 % |

| Verdipapirfondet DNB Norge (IV) | 1,610,416 | 1.24 % |

| Danske Invest Norske Aksjer Inst. II | 1,582,523 | 1.22 % |

| State Street Bank and Trust CO (nominee) | 1,500,963 | 1.16 % |

| Citibank N.A New York Branch (nominee) | 1,487,429 | 1.15 % |

| Odin Europa SMN | 1,326,937 | 1.02 % |

| The Bank of New York Mellon (nominee) | 1,256,461 | 0.97 % |

| Forsvarets Personellservice | 1,189,246 | 0.92 % |

| Tonsenhagen Forretningssentrum AS | 1,135,193 | 0.87 % |

| Danske Invest Norske Aksjer Instit. I | 1,085,745 | 0.84 % |

| State Street Bank and Trust CO (nominee) | 1,006,198 | 0.77 % |

| The 20 largest ECC holders in total | 41,797,271 | 32.19 % |

| Others | 88,039,172 | 67.81 % |

| Total issued ECCs | 129,836,443 | 100.00 % |

Dividend policy

SpareBank 1 SMN aims to manage the Group’s resources in such a way as to provide equity certificate holders with a good, stable and competitive return in the form of dividend and a rising value of the bank’s equity certificate.

The net profit for the year will be distributed between the owner capital (the equity certificate holders) and the ownerless capital in accordance with their respective shares of the bank’s total equity capital.

SpareBank 1 SMN’s intention is that up to one half of the owner capital’s share of the net profit for the year should be disbursed in dividends and, similarly, that up to one half of the owner capital’s share of the net profit for the year should be disbursed as gifts or transferred to a foundation. This is on the assumption that capital adequacy is at a satisfactory level. When determining dividend payout, account will be taken of the profit trend expected in a normalised market situation, external framework conditions and the need for tier 1 capital.

2nd quarter 2013

- Main figures

- Report of the Board of Directors

- Income statement

- Balance sheet

- Cash flow statement

- Change in equity

- Equity capital certificate ratio

- Results from quarterly accounts

- Key figures from quarterly accounts

- Notes

- Statement in compliance with the securities trading act, section 5-6

- Equity capital certificates

- Auditor's report